By Tanner Elvidge

As one of the first B Corps to IPO, can Etsy strike a balance between its fiduciary duty and its social pledge?

Etsy (NASDAQ: ETSY) is an online marketplace that allows individuals across the globe to buy and sell unique goods with the stated mission: “to reimagine commerce in ways that build a more fulfilling and lasting world.” In line with this mission, Etsy has consistently pursued avenues to invest in its employees, its community of buyers and sellers, and the environment. These commitments led to the company attaining B Corp status in 2012.

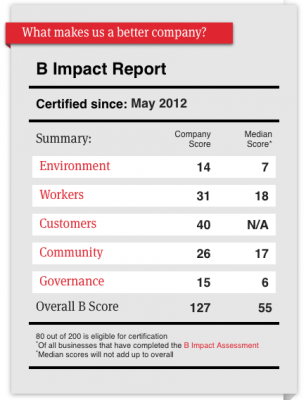

Etsy has taken its social pledge as a B Corp seriously since being certified. Today, the company boasts an impressive impact scorecard, with scores well above the median in every category and noticeable outperformance in environment, community, and governance. Its overall rank is 127 out of 200, a significant margin above the median B Corp rating of 55.

Etsy also takes its growth very seriously. The company has grown tremendously since its inception in 2005. By 2015, it had a global marketplace consisting of 27 million buyers and nearly 2 million sellers, driving $2.4 billion in gross merchandise sales.

These impressive growth metrics have attracted the attention of prominent investors; throughout its lifetime, Etsy has raised over $266 million in Venture Capital and ultimately went public in 2015 with a valuation of $1.78 billion. It is one of the first prominent B Corps to go public.

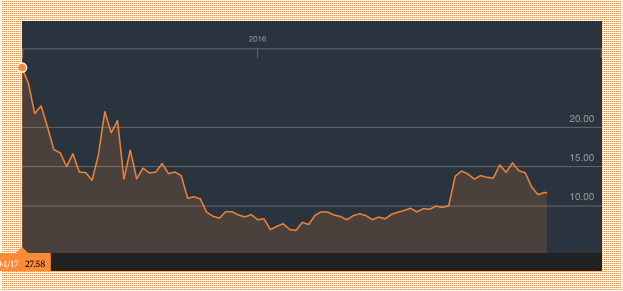

Since its IPO, however, Etsy’s stock has had a tumultuous ride; immediately after trading commenced at $16 per share, the price skyrocketed to roughly $30 per share. Since then, the stock has lost significant value, hitting an all-time low of $6.04 in February. Today, the share price has seen a slight rebound to $12.09 (as of December 5th), but has been unable to recover to its original offering price.

Source: Bloomberg (https://www.bloomberg.com/quote/ETSY:US)

This questionable performance has led to some speculation about Etsy’s B Corp certification. Namely, is Etsy’s commitment to its B Corp values hindering its ability to perform in public markets?

Every investor methods and considerations vary when purchasing stock, but there are basic underlying theories that the vast majority of investors believe. The most basic and widely accepted theory is a company’s value is the present value of all future cash flows. In English, the value of a company today reflects all the money available to shareholders in the future. This has two important implications.

First, healthy cash flows are incredibly important to investors. Cash flows are influenced by topline revenue and costs. Given this, companies can improve their cash flows in one of three ways: growing topline revenue, decreasing operating expenses, or a combination of the two.

Second, the fundamental valuation of a company is almost completely informed by future projections. This creates an equation that’s inherently prone to volatility over time because unpredicted information causes reevaluation of those projections. The reevaluation directly drives stock price movement as investors adjust their positions according to the new forecasts. This volatility is particularly present for young companies, who see more quarterly volatility in market conditions, revenues, and costs than more established companies.

In evaluating Etsy with these two considerations in mind, there are a few trends that are important to notice. The first is that the company has experienced a rapid topline revenue growth over the past three years, growing 56.4% from 2013 to 2014 and 40% from 2014 to 2015. This is a great start for healthy cash flows, but unfortunately the company has also experienced a drastic increased loss during the same period as a result of increasing costs.

The cost of revenue as a percentage of sales is falling consistently. Operating costs are the largest cost category and have increased as a percent of sales of the last three years. Within operating costs, marketing expense has increased by 10.1%, product development has fallen 6.4%, and administrative costs have held steady (all numbers as a percentage of sales). The drastic increase in marketing expense is a key driver for the company’s increasing operating costs.

It becomes critically important, then to understand if those cost increases are inherent in the way Etsy operates or if they were purposefully incurred by management. If the high costs are inherent in operations, shareholders can legally pressure the company to reduce them. This could prove disastrous for Etsy’s continued commitment to its B Corp certification.

Management has made clear in its review of performance that it is heavily investing in marketing to grow the Etsy user base. This short term marketing push may have a negative impact on current financial performance, but it has the clear potential to dramatically improve Etsy’s long-term profitability. Nearly one third of sellers and over 44% of buyers remain active on the Etsy platform for more than four years. Not only do these individuals stay active, they also have a high propensity to purchase repeatedly; nearly 81% of Etsy’s gross merchandise sales are driven by repeat customers. If these metrics continue to hold, a successful marketing push now will lead to a drastic increase in active users that will drive revenue for Etsy for a prolonged period.

If the push is successful, Etsy can reduce its marketing spend in future years without seeing a significant reduction in revenue. When combined with the historical decline in revenue costs and product development costs, this marketing spend can push the company into profitability in future years without reducing or eliminating commitment to B Corp activities.

While the financial case can be proven given Etsy’s current B Corp commitments, investors may argue that the profit margin will be smaller with those activities than it would be if they were eliminated. This could be the case, but it seems unlikely. Ultimately, Etsy’s success depends on its community of buyers and sellers. Its buyers are labeled “thoughtful consumers.” They care more for authenticity and sustainability than price and convenience. They want to know how and where items were made, and who made them. Etsy is aware of this and goes to great lengths to ensure a diverse community of sellers; 86% are women and 76% of them consider their Etsy store to be a meaningful business. This precise growth of and investment in the community is directly attributed to the company’s B Corp commitments, as outlined in their impact report.

If Etsy were to forego its commitment to generating a diverse community, its sustainable practices, and its authenticity for a profit-maximizing, mass-produced and homogenized marketplace, it would slowly lose the very lifeblood of its business. No amount of financial analysis could ever bring it back.