Earning a graduate degree is a great way to advance your career, improve your skill set, and increase your earning potential. However, many people are concerned about the affordability of an advanced education.

Most graduate schools have an array of financial aid options, such as scholarships, grants, and work-study. If these options aren’t enough to cover the cost of graduate school, however, don’t despair. If you’re currently employed, then you might be eligible for tuition reimbursement. Approximately 48 percent of employers currently offer tuition assistance as a benefit.

Here’s an overview of tuition reimbursement and how you can effectively use it to fund your advanced education.

What is Tuition Reimbursement?

Tuition reimbursement (also known as tuition assistance) is an employee benefit through which an employer pays for a pre-determined amount of continuing education credits or college coursework to be applied toward a degree. These programs are intended for employees hoping to advance their education as it relates to their current career track, offering the chance to increase their industry knowledge and develop advanced skills.

These benefits are widely available, although under-utilized. On average, U.S. companies spend 28 billion dollars annually on educational assistance programs. On average, however, only 2 percent of eligible employees take advantage of tuition assistance programs, and more than 60 percent of working professionals are unaware of their employer’s benefits.

On average, companies spend somewhere between $10,500 for employees pursing graduate degrees, although organizations are beginning to increase their educational benefits as they see the positive impact they can have on their business. Many companies pre-pay for students’ coursework to encourage participation in their tuition reimbursement program. These programs vary, however, so it’s crucial that you review the program details before assuming your college coursework will be fully covered. You may have to foot the bill upfront and submit a request for reimbursement in accordance with your employer’s tuition assistance policy.

While specific program policy details differ by organization, here are a few commonalities to keep in mind.

Tuition Reimbursement Requirements

Tuition reimbursement programs often contain employee and coursework eligibility requirements. Your employer’s program eligibility requirements may differ from the samples provided here.

Program Requirements

- An annual reimbursement limit (often capped at $5,520) may be assigned per employee based on their current job title. Employer tuition assistance usually won’t cover the entire cost of a degree program, but it can make a major difference in your ability to pay for school.

- Reimbursement may be limited to four-year schools or to a specific list of accredited institutions.

Coursework Requirements

- Eligible coursework is often limited to subjects related to your current job.

- Employers may require that employees earn a specific grade—such as a “B” or higher—to qualify for tuition reimbursement.

Timeframe Requirements

- Employers typically don’t offer tuition reimbursement just to reduce turnover, but also to experience a return on the investment. Employers might require that employees remain employed for a specified period after completing the coursework before the payment is processed. The period can range anywhere from a few months to several years.

Tuition Reimbursement Programs are a Win-Win

Tuition reimbursement programs offer clear benefits to employees looking to upskill and advance. Those who take advantage of these programs know they can turn their employer’s financial support into a graduate degree that will carry them the rest of their professional career. But what’s in it for the employer?

Benefits of Tuition Reimbursement for Employers

As with most employee benefits, tuition reimbursement programs are designed to reduce turnover and attract additional qualified candidates to the organization. Many companies around the world (including at least 25 major employers in the Boston area) understand the value of tuition reimbursement programs and actively use it as a tool to recruit new talent.

Here’s a list of tuition reimbursement program benefits for employers:

- Attracts talent: Tuition reimbursement programs can be an excellent incentive for talented prospective employees to join an organization.

- Reduces turnover: These programs can incentivise employees to remain at the company, particularly if they have a specific requirement regarding how long an employee has to work at the company to maintain the benefit.

- Saves money: An Accenture study found that investing in employees pays off big. For every $1 a company spends on educational assistance programs, they save an average of $1.29 in recruiting costs. There’s also a tax benefit to employers who offer tuition reimbursement programs.

- Boosts employee development: By upskilling their employees, companies also have more promotable staff which lowers the cost of hiring new personnel.

- Increases employee engagement: Organizations with educational assistance programs also benefit from more engaged employees. Employees feel valued, knowing their employer supports their professional development, which 86 percent of employees report as very important to them.

Benefits of Tuition Reimbursement for Employees

While the most apparent benefit of employee tuition reimbursement is the additional source of college funding that’ll reduce your reliance on student loans, some other benefits can’t be measured in dollars and cents. Tuition reimbursement benefits employees in several key ways, including:

- Tax savings: Unlike other employee perks related to money (e.g., 401k plans, monetary bonuses, etc.,) tuition reimbursement benefits aren’t reported on your federal income tax as income. The amount you receive in employer assistance should not be reflected on your IRS Form W-2 unless it exceeds $5,250 during the tax year.

- Professional confidence: The completion of your graduate degree can help build your confidence in the workplace.

- Chance of promotion: If you take advantage of a tuition reimbursement program, you’ll be 21 percent more likely to be promoted and on the path to receiving 40 percent higher wage increases compared to co-workers who pass on the opportunity.

- Motivation: With the increased confidence advanced education can provide, you’ll be able to inspire those around you, showing them that determination and resourcefulness can help you achieve anything.

How to Get Started

Take advantage of your company’s tuition reimbursement program by contacting the human resources department and following the steps below.

1. Request a Copy of Their Tuition Assistance Policy and Read the Fine Print

You’ll want to identify any program requirements and limitations before you enroll in classes. Even if your employer has not entered into a training agreement with an educational institution, there may be restrictions on which educational credits qualify for reimbursement. For example, college credit completed at a community college may be eligible while coursework completed at a local private post-secondary institution may not be.

2. Communicate With Your HR Representative About Your Educational Goals

Let your HR representative know that your objective is to obtain a graduate degree. They can assist you with getting the most out of your company’s tuition reimbursement program.

3. Find out What Signatures Are Required

In most cases, prior approval is required from your employer before enrollment. You’ll also want to confirm whether your employer requires you to remain employed for a specified period after the course is completed. Make sure you check with HR so you’re not left with unexpected tuition obligations.

Lastly, some employers may require you to complete a Free Application for Federal Student Aid (FAFSA) before submitting a request for reimbursement. This encourages employees to exhaust other options before applying for tuition reimbursement. It’s important to clarify these details beforehand.

4. Follow Up on the Paperwork

Make sure you submit the required paperwork to your employer before classes begin. Once classes are completed, ensure the necessary documentation for reimbursement is processed promptly.

Keep in mind, your current employer may not advertise the availability of their program, so be sure to connect with your human resources department today. Even companies without formal tuition reimbursement programs may consider offering this perk if you can convince them of the benefits.

Maximize Your Benefits

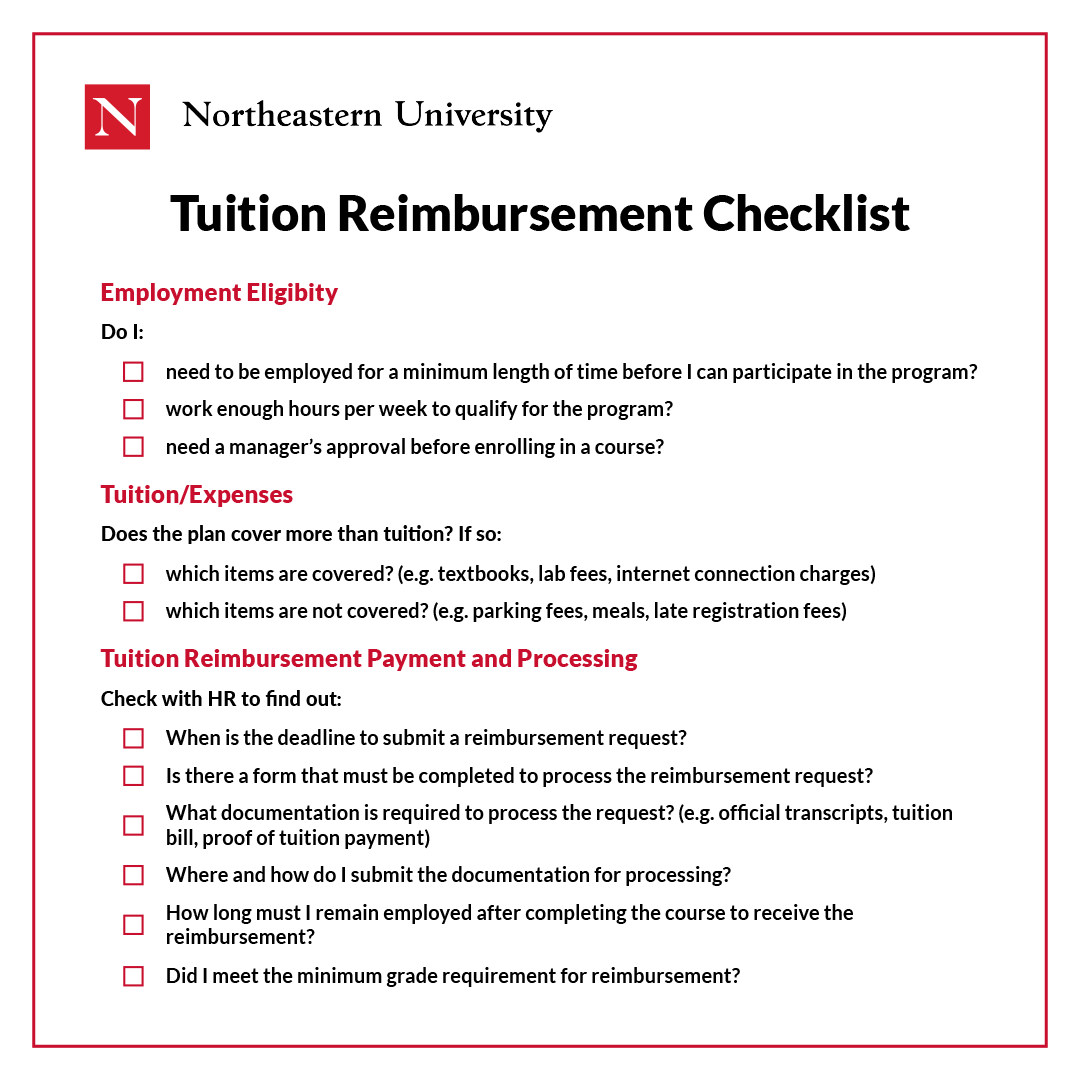

The only way to take full advantage of this employee benefit is to understand your employer’s participation requirements. Use the following checklist to get the most out of your employer’s tuition reimbursement program:

Take the Next Step

You can obtain your graduate degree by tapping into all available funding sources, including Federal Student Aid programs, scholarships, and state grants. Consider your overall graduate school financing plan and how it aligns with your employer’s tuition reimbursement policy.

If you can reduce the cost of going back to school by exhausting the annual limits of your company’s tuition reimbursement program, this benefit may hold the financial key to completing your degree.

Want to learn more about funding options for grad school? Explore our financial aid options or connect with our team to receive personalized advice today.

Related Articles

Why Earn a Professional Doctoral Degree?

5 Tips to Get the Most out of Grad School

Is Earning a Graduate Certificate Worth It?