If you’re considering a career in accounting or finance, now is the right time to make your move. Financial occupations are expected to grow eight percent by 2030, and the industry’s competitive wages make an accounting or finance career an attractive choice.

In 2022, the median annual pay for all business and financial occupations was $76,850, with specific occupations such as financial analysts averaging more than $96,220.

Is It Better to Major in Finance or Accounting?

Job seekers in this field will quickly find, however, that most employers require a bachelor’s degree—even for many entry-level positions. If you’re interested in (or have prior work experience in) areas like budgeting, historical financial analysis, or financial projections, a business degree is likely the right path for you. But which should you pursue: a bachelor’s degree in accounting or finance?

The accounting and finance disciplines are closely related, which can make it tough to decide which degree will help you reach your career goals and land the job you want. Here, we break down the differences between the two disciplines and introduce a program that combines the best of both degrees so you can align your interests and skills with a degree that will put you on the path to success.

Learn more about Northeastern’s Bachelor of Science in Finance and Accounting Management

Get the skills you need to advance your organization and your career.

The Difference Between Accounting and Finance

Accounting and finance professions, at their core, are similar. Both accounting and finance deal with money, involve the recording of financial transactions, require critical thinking skills, and incorporate information technology to help small businesses and major corporations track and organize financial information.

The disciplines are also interrelated and rely on one another. For example, a finance professional often needs the data compiled by an accountant to provide accurate projections about a company’s future viability.

But, there are several major differences between accounting and finance that are helpful to be aware of before pursuing a career in either.

What is accounting?

Accounting focuses on creating an accurate reflection of fiscal activities and presenting financial information to both internal and external stakeholders. This information is based on:

- Historical financial analysis

- Annual, quarterly, and monthly budgeting

- Business planning

- Cash flow analysis

- Day-to-day financial operations

Accounting is concerned with communicating, interpreting, and presenting financial information through the use of detailed reports (e.g., balance sheets, cash flow statements, income statements). Accountants must follow a set of rules known as Generally Accepted Accounting Principles (GAAP) when generating reports to maintain clarity and consistency.

In addition to creating reports, accountants might participate in specialized tasks such as bookkeeping, auditing, tax return preparation, and cost allocation. They are also responsible for the tracking of expenses and revenues, internal reporting, financial risk management, and financial reporting.

What is finance?

Finance focuses on the future performance of the organization, including:

- Long-term financial projections

- Allocation and management of assets and liabilities

- Fiscal performance forecasts

- Future growth planning strategy

While accounting produces a snapshot of a company’s financial health at a specific point in time, finance is more concerned with forecasting and planning for the future.

Finance also deals heavily with capital management and allocation. Depending on their specialization, finance professionals might participate in tasks like investing, budgeting, lending, and borrowing.

Financial professionals are often involved in raising capital (through debt and equity) to fund the operations of the business while seeking to optimize risk-adjusted returns. These professionals will also often have a direct hand in shaping a corporation’s strategy, and can significantly impact major endeavors such as mergers and acquisitions.

Is it possible to combine an accounting and finance degree?

If you feel like your skills in interests lie somewhere in-between the two disciplines (e.g., you have the technical skills to perform calculations quickly and accurately, but you also like analyzing the business effects and ROI of financial transactions,) you’re probably wondering which degree path is best. What if there was a way for you to study both subjects in the time it takes to study one?

The Bachelor of Science in Finance and Accounting Management program (BS in FAM) at Northeastern allows you to do just that, integrating the most critical aspects of both the finance and accounting industries. Accredited by the Association to Advance Collegiate Schools of Business (AACCB), this program not only gives graduates an edge over peers who graduate with a single-focus degree but also exposes them to a holistic view of the business and finance fields.

Program graduates enter the workforce with a combination of analytical capabilities that gives more career choices than they’d have with either individual degree. Graduates of the Bachelor of Science in Finance and Accounting Management program must complete at least 120 semester credit hours with a minimum 2.0 GPA.

A capstone course gives students a unique competitive advantage in the workforce and sets Northeastern’s BS in FAM apart from other business programs in the U.S. In this course, students demonstrate their knowledge of the skills learned in the program, applying learnings from their finance and accounting courses as well as complementary disciplines such as organizational behavior and management information systems.

The experiential learning portion of the program is another unique opportunity for students to solve business problems in the real world while still in school, says Monica Borgida, faculty lead for Northeastern’s Finance and Accounting Management program. Experiential learning encourages students to collaborate with industry professionals to explore a particular accounting or finance topic.

“For six to 12 weeks, students can interact with companies with a focus on accounting or finance,” she says. “Students have opportunities for exposure to both accounting and finance through collaborative projects with industry sponsors and organizations.”

This weekly real-world collaboration reinforces the academic concepts learned in the classroom. This not only builds confidence and expands a student’s professional network but also allows students to see first-hand how a particular finance and accounting role supports an organization. This experience also helps students determine the position they’d like to apply for after graduation.

What careers do finance and accounting graduates pursue?

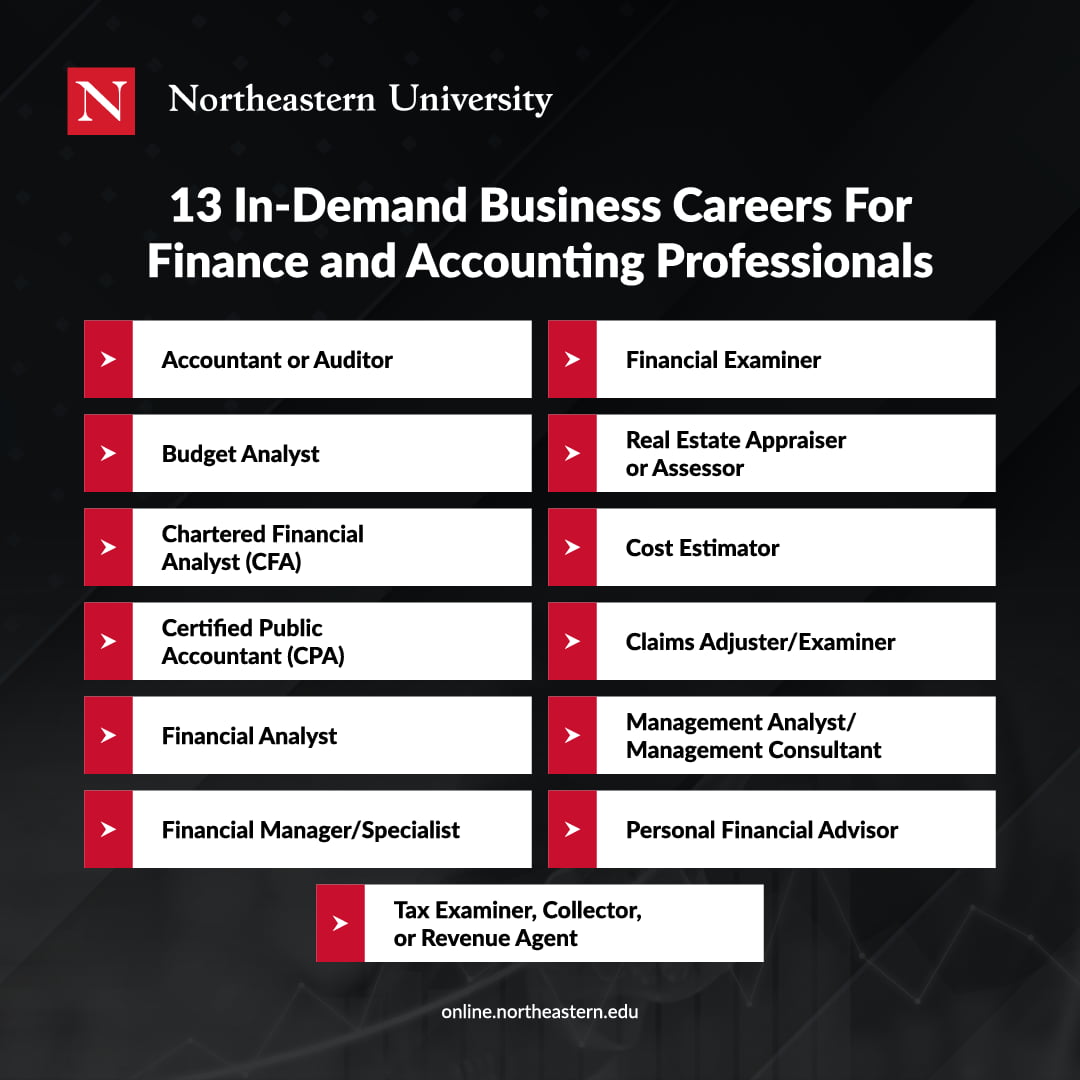

According to the Bureau of Labor Statistics (BLS), the growing need for accounting and financial professionals is largely due to the growing economy, globalization, and the continued complexity of taxes and regulations. Along with the abundance of career opportunities, graduates of the BS in FAM program will enjoy great career flexibility, as they can decide whether they want their career’s primary focus to be accounting or finance.

Rather than being limited to choosing an accounting OR finance role, having an educational background in finance and accounting prepares you for a variety of in-demand business careers including:

-

- Accountant or auditor

- Budget analyst

- Chartered financial analyst (CFA)

- Certified public accountant (CPA)

- Financial analyst

- Financial manager/specialist

- Financial examiner

- Real estate appraiser or assessor

- Cost estimator

- Claims adjustor/examiner

- Management analyst/Management consultant

- Personal financial advisor

- Tax examiner, collector, or revenue agent

Take the Next Step in Your Career

Ready to take the next step toward your business career? You can expand your options by enrolling in a bachelor’s degree that includes both accounting and finance coursework. Doing so will prepare you for a range of potential careers that fall under the broader category of finance and accounting, like those listed above. It can also be beneficial to aspiring entrepreneurs, who will need a solid understanding of business (including accounting and finance) in order to turn their dreams into a reality.

Neither prior industry work experience nor college coursework is required to take advantage of the learning opportunities available with a Bachelor of Science in Finance and Accounting Management degree.

Get in touch with our enrollment team today about fall, spring, or summer entry terms.

Editor’s note: This article was originally published in February 2019. It has since been updated for accuracy.